Sourcing electric vehicle parts from around the globe is a complex process filled with risk. A heavy dependence on any single region can create major supply chain 1 vulnerabilities for your projects.

The vast majority of EV parts are made in China. This includes the most critical and high-value components like battery cells, electric motors, electronic control units, and the large, complex aluminum die-cast parts that form the vehicle’s structure.

This concentration of manufacturing in one country is a major topic for my clients in Europe and North America. As an engineer working within this system at EMP Tech, I see the reasons for this dominance every day, but I also understand the challenges it presents to global automakers. Let’s look closer at how this powerful ecosystem works and what it means for the future of the automotive industry.

Why Does China Dominate Global EV Parts Production?

Many countries have long-established automotive industries. So why has China pulled so far ahead in the electric vehicle race? This didn’t happen by accident; it’s the result of a deliberate, long-term national strategy.

China dominates EV parts production due to a powerful combination of early and consistent government support, huge domestic market demand, and strategic control over key raw material processing. This created a complete industrial ecosystem, from mine to motor, that is unmatched in scale.

The groundwork for today’s dominance was laid more than a decade ago. It was a focused effort to lead the next generation of transportation. From my perspective on the ground, this created a unique environment for growth and investment that has been hard for other regions to replicate.

A Strategy of Comprehensive Support

The Chinese government provided massive support to the industry from the very beginning. This included subsidies for vehicle purchases, funding for charging infrastructure, and investment in research and development. This created a predictable, high-growth environment that encouraged companies to invest heavily in manufacturing capacity.

The Unmatched Power of Scale

China2‘s enormous domestic market for EVs allowed suppliers to scale up their operations at an incredible speed. This massive scale brings down production costs for everyone. At my company, we can invest in the latest and most efficient die casting machines because we have the high production volumes needed to make that investment pay off. This efficiency benefits all of our clients, both here in China and internationally.

Which EV Components Are Primarily Manufactured in China?

You already know that China is a major player in the EV supply chain. But which specific parts are you most likely sourcing from here? The answer covers the most expensive and technologically critical parts of the vehicle.

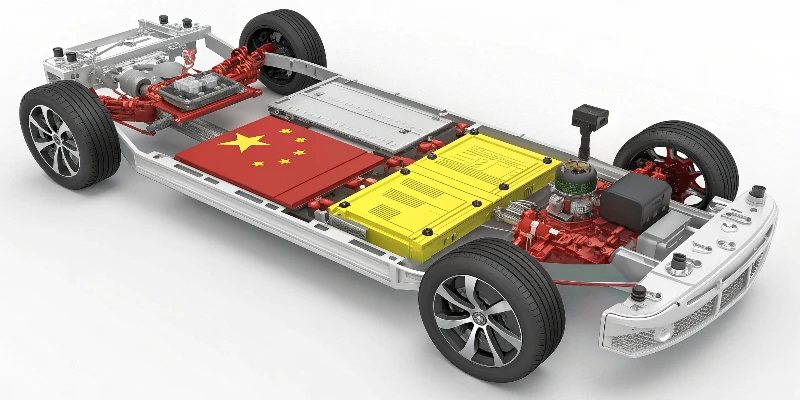

China is the primary manufacturer for the most vital EV components. This includes over 75% of the world’s battery cells, a majority of permanent magnet motors, advanced power electronics, and a huge share of the structural aluminum castings for battery enclosures and bodies.

In the Chinese auto industry, we often talk about the "three electrics" as the core of any new energy vehicle. These are the battery, the electric motor, and the electronic control system. China has built a dominant position in all three of these foundational areas, making it the world’s one-stop shop for EV manufacturing.

Core Component Manufacturing

The level of concentration is stunning when you look at the numbers. It’s not just one component; it’s the entire system.

| EV Component | China’s Estimated Global Share | Key Notes |

|---|---|---|

| Battery Cells & Packs | >75% | Dominance in both LFP and NMC battery chemistries. |

| Permanent Magnets (for motors) | >90% | Near-monopoly on refining rare earth metals. |

| Aluminum Die Castings | >50% | Leading in large, complex "Giga Castings." |

| Motor Controllers/Electronics | >60% | A global hub for power electronics manufacturing. |

How Has China Become the World’s Largest EV Battery Supplier?

The battery is the new engine and the single most expensive part of an EV. How did one country secure such a massive and commanding lead in producing this critical component?

China became the world’s top EV battery supplier by focusing on and securing the entire midstream supply chain. This includes the chemical refining of critical raw materials like lithium, cobalt, and graphite. Domestic giants like CATL and BYD then built mega-factories at an unmatched scale.

This is a key point that many people miss. It is not just about having the mines; it is about controlling the complex chemical processing that turns raw minerals into high-purity, battery-grade materials. China established a huge lead in this area years ago.

From Raw Material to Battery Module

By dominating the refining stage, Chinese companies secured the essential ingredients needed for battery production. This allowed them to build enormous battery factories, known as gigafactories3, with confidence in their supply chain. This vertical integration provides a massive cost and stability advantage.

Scale Drives Innovation

The sheer scale of companies like CATL and BYD allows them to invest heavily in R&D. They were leaders in commercializing lower-cost LFP (Lithium Iron Phosphate) battery technology, which is now being adopted by automakers around the world. As a supplier, my team designs aluminum battery enclosures specifically to fit the module dimensions of these major battery producers, showing how deeply integrated the supply chain really is.

What Role Do Chinese Aluminum Die Casting Companies Play in EV Manufacturing?

Lightweighting is absolutely essential for maximizing an EV’s driving range. So how did Chinese suppliers like my own company become the go-to source for the large aluminum parts that make this possible?

Chinese aluminum die casting companies play a critical role by producing large, highly integrated structural parts for EVs. Using advanced technology like Giga Presses, we manufacture single-piece battery trays, shock towers, and underbody components that reduce weight, lower costs, and simplify vehicle assembly.

This is the part of the industry where I have spent my career. The move toward large, single-piece castings has been one of the biggest manufacturing shifts in the auto industry in decades, and Chinese companies have been at the forefront of this change.

The "Giga Casting" Revolution

Instead of assembling a car’s frame from dozens of smaller stamped steel and aluminum pieces, automakers are now using massive die casting machines to create one single, complex part. Chinese suppliers were early and aggressive adopters of this technology. This allows us to help automakers build cars with fewer parts, lower weight, and reduced capital investment.

A Full-Service Partnership

For my international clients, working with a supplier like EMP Tech is about more than just getting a casting. We provide a complete solution, from Design for Manufacturing (DFM) and mold flow analysis in the early stages to finished, inspected parts ready for their assembly line. We are certified to IATF 16949 and understand the quality expectations of German, American, and other global customers. This makes it easy for them to leverage our advanced manufacturing capabilities with confidence.

How Do Global Automakers Depend on Chinese EV Supply Chains?

You often hear about "decoupling" from China in the news. But is that realistic? The reality on the ground is that Western automakers are deeply and structurally integrated with Chinese suppliers.

Global automakers depend on the Chinese EV supply chain for reliable access to cost-effective, high-volume, and technologically advanced components. Sourcing batteries, motors, and large structural parts from China is often the only way to meet production targets and price points for mass-market EVs.

This dependency is a simple matter of business reality. When I talk to procurement directors from Europe, the conversation always comes back to a few key points: cost, capacity, and capability.

The Equation of Cost and Scale

For any mass-market vehicle program, cost is king. The sheer scale of production in China’s EV supply chain has created efficiencies that are very difficult to match elsewhere. The capacity is also a major factor. If an automaker needs one million battery packs4 or motor controllers per year, China is often the only place that can reliably deliver that volume.

A Deeply Integrated Web

Many global automakers have joint ventures and have been building cars in China for decades. This has created deeply integrated supply chains. I work with European Tier 2 suppliers who provide parts to German car brands, but for their factories located right here in China. The supply chain isn’t a simple line from East to West; it’s a complex global web with its center of gravity located here.

Can Other Countries Reduce Their Reliance on Chinese EV Parts?

Governments in the United States and Europe are pushing hard for local production with new policies and incentives. But building an entire supply chain from the ground up is a monumental challenge. What is the realistic outlook?

Yes, other countries can and will reduce their reliance, but it will be a gradual, expensive, and decade-long process. The US and EU are investing billions to "reshore" battery and component manufacturing, but they face immediate challenges in production scale, cost competitiveness, and securing their own raw material supply chains.

We are watching these developments very closely with our clients. Policies like the Inflation Reduction Act (IRA) in the US and the EU’s battery regulations are actively reshaping global investment flows. A change is definitely happening.

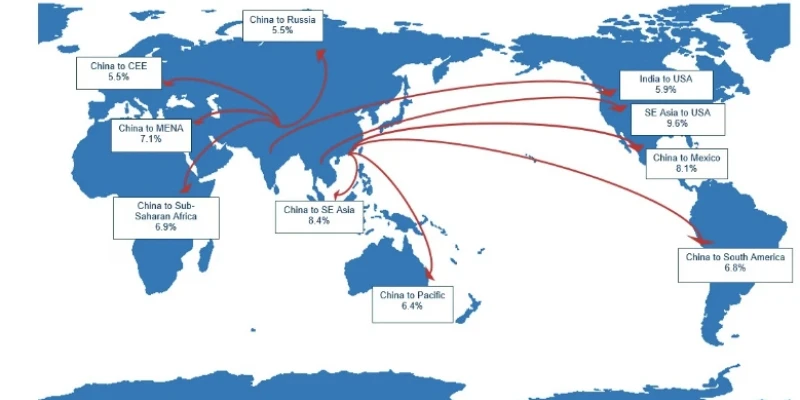

The "China Plus One" Reality

While we see our clients exploring new suppliers in Mexico, Eastern Europe, or Southeast Asia, they also know that the scale and integration of China’s ecosystem cannot be replicated quickly. It took 15 years to build. Therefore, the most common strategy I see emerging is "China + 1." Companies are not leaving China; they are building resilience by adding a second source of supply in another region.

Diversification, Not Replacement

The goal for most global companies is diversification, not complete replacement. They want to reduce the risk of having all their eggs in one basket. So, for the foreseeable future, the strategy will be to maintain their core, high-volume supply relationships here in China while slowly building up capabilities in other parts of the world. It is a pragmatic response to a complex geopolitical and economic situation.

Conclusion

China will remain the world’s EV parts5 factory for the foreseeable future. For global automakers, the key strategy is not to leave, but to build smarter and more diversified supply chains.

-

Gain insights into the complexities of the EV supply chain and its global implications. ↩

-

Explore the reasons behind China’s dominance in EV parts manufacturing and its implications for the global market. ↩

-

Explore the concept of gigafactories and their significance in scaling battery production. ↩

-

Explore the global market dynamics of battery packs and China’s role in it. ↩

-

Understanding the sources of EV parts can help you make informed decisions about sourcing and supply chain management. ↩