Making strategic decisions without understanding the market’s direction is a huge risk. You can end up investing in outdated technology or missing growth opportunities, allowing competitors to get ahead.

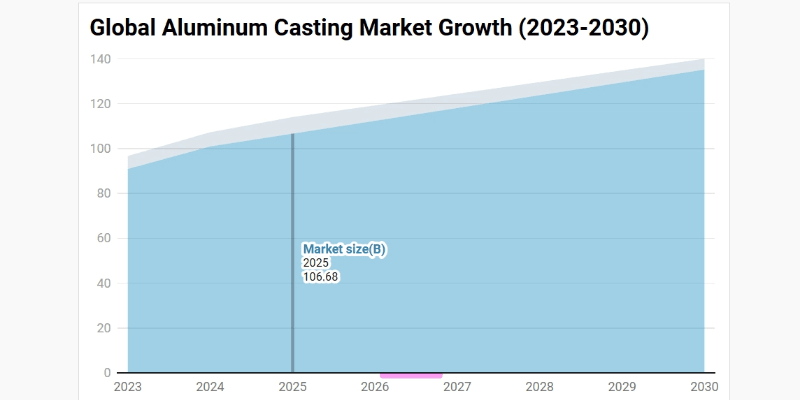

The global aluminum casting market is massive, valued at over USD 100 billion in 2024 and projected to reach approximately USD 106 billion in 2025. This growth is primarily fueled by the automotive sector’s increasing demand for lightweight and high-performance components.

For over 20 years, I’ve had a front-row seat to the evolution of this industry. I’ve seen it grow from a traditional manufacturing process into a high-tech powerhouse. The numbers are impressive, but the story behind them is what truly matters for professionals like us. It’s about a fundamental shift in manufacturing, driven by the need for efficiency, performance, and sustainability1. The scale of this market means more innovation, more opportunities, and more pressure to get it right. Let’s dig into the specifics to understand where this market is and where it’s headed.

What is the current size of the global aluminum die casting market in 2025?

You hear that the market is growing, but without concrete numbers, it’s hard to justify new projects. Vague estimates can lead to poor investment decisions and missed opportunities for your company.

Projections for 2025 place the global aluminum casting market value at approximately USD 106 billion. The die casting process, particularly high-pressure die casting (HPDC), represents the largest and fastest-growing segment, thanks to its efficiency in high-volume production for the automotive industry.

When I started as a technician on the workshop floor, the conversations were all about meeting the current order quota. Today, in my role as an engineering consultant, the discussions with clients are about long-term strategy and global supply chains. The market’s massive scale reflects this shift. This isn’t just one industry; it’s a collection of vital sectors. The transportation sector, which includes automotive, is by far the biggest consumer. But we also see strong demand from industrial applications, construction, and telecommunications. The die casting segment’s dominance is no surprise to me. For producing complex, precise parts at scale—like the motor housings and controller casings we specialize in—there is no better process. The sheer value of this market underscores the critical role aluminum casting plays in modern manufacturing.

How fast is the aluminum casting industry growing in automotive and EV sectors?

You know electric vehicles are a hot topic, but how much are they really impacting your supply chain? Underestimating this trend could leave you unprepared for the rapid shift in component demand.

The aluminum casting market is growing at a compound annual growth rate (CAGR) of over 7% within the transportation sector. This growth is massively accelerated by electric vehicles (EVs), where aluminum usage is 25-27% higher than in traditional internal combustion engine cars.

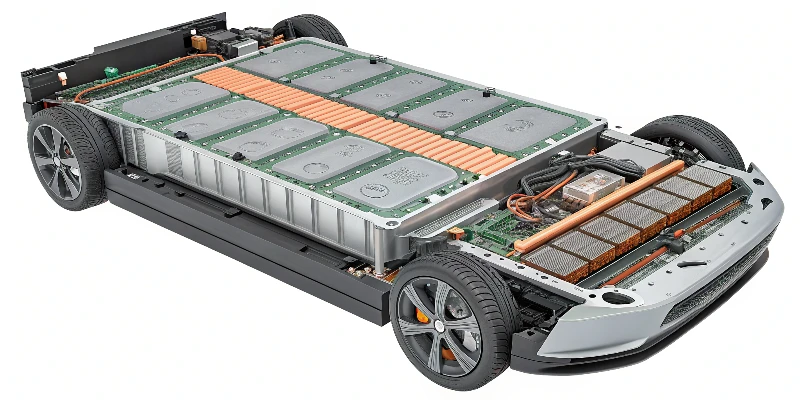

Five years ago, EV-related projects were a growing part of our business at EMP Tech. Today, they are the main driver of our work, making up the majority of our new development projects. This isn’t just a trend; it’s a complete transformation. Traditional cars use aluminum for engine blocks and transmission cases. But in an EV, the applications explode. We’re casting large, complex battery enclosures, lightweight motor housings, and intricate inverter casings. These aren’t just simple parts; they are critical structural and thermal management components2. The reason for this accelerated growth is simple: lightweighting. Every kilogram we save with aluminum extends the vehicle’s range. This direct impact on performance is why our customers, from German Tier 1s to American EV startups, are pushing the boundaries of what we can achieve with die casting.

Your company operates globally, but supply chain risks3 are regional. Sourcing from a region without understanding its market position can lead to unexpected disruptions, quality issues, or uncompetitive pricing.

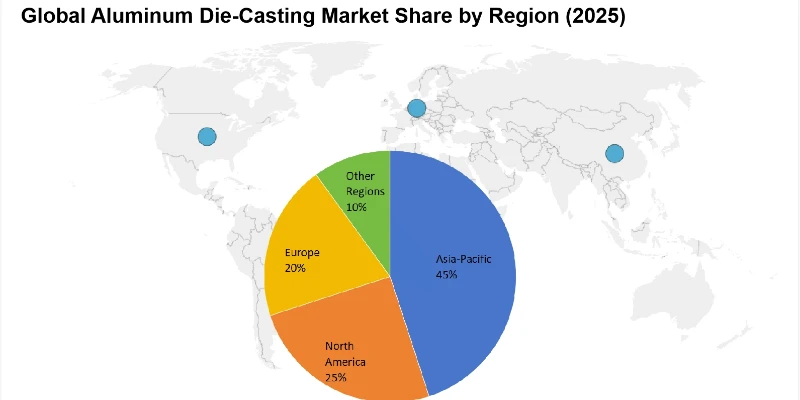

The Asia-Pacific (APAC) region, led by China, dominates the global aluminum die casting market, holding over 50% of the market share. Europe, particularly Germany, is a center for high-quality automotive casting, while North America shows strong growth, driven by EV investments.

My work has taken me to customer sites across the globe, and this regional breakdown is something I see firsthand. China4‘s position as the "world’s factory" gives it an unmatched scale in production. The sheer volume of manufacturing, from consumer electronics to automotive, makes APAC the undisputed leader. In Europe, especially when I work with our German clients, the focus is intensely on precision, quality, and adherence to standards like IATF 16949. They are pioneers in complex automotive components. In North America, I’ve seen a recent surge of energy and investment, particularly in building out a domestic supply chain for EVs in the U.S. and Canada. Each region has its unique strengths and challenges, which is critical information for a purchasing director trying to build a resilient and cost-effective global supply chain.

| Region | Market Position | Key Characteristics |

|---|---|---|

| Asia-Pacific | Dominant Leader (>50%) | Led by China and India. Massive manufacturing scale, cost-effective labor, and rapid growth in domestic automotive markets. |

| Europe | Strong Contender | Led by Germany. Focus on high-quality, precision engineering for the automotive sector. Strong emphasis on sustainability and recycling. |

| North America | Growing Fast | Significant investments in the EV supply chain. Strong automotive and aerospace industries. Abundant raw materials. |

Why is aluminum die casting essential for electric vehicle battery housings and motor parts?

You see "aluminum housing" on a spec sheet, but why that material? Not understanding the critical functions it serves can lead you to accept subpar alternatives or fail to challenge a supplier on quality.

Aluminum die casting is essential for EV parts because it provides a unique combination of lightweight strength, excellent thermal conductivity, and the ability to form complex, EMI-shielded enclosures. This is critical for protecting batteries, cooling electronics, and maximizing vehicle range.

I spend most of my days working on these exact components. An EV battery housing is not just a box. It’s a structural part of the vehicle, so it needs to be incredibly strong to protect the cells during a crash. At the same time, it has to be lightweight. On top of that, it acts as a giant heat sink. We design and cast complex cooling channels directly into the housing to manage battery temperature, which is crucial for performance and safety. The same goes for motor and inverter housings. They need to be light, strong, and dissipate heat effectively. Furthermore, these aluminum casings provide essential electromagnetic interference (EMI) shielding to protect the sensitive electronics inside. No other process can deliver this combination of features with the precision and repeatability of high-pressure die casting.

How does aluminum die casting compare with steel and magnesium in lightweight manufacturing?

Your engineers are debating between aluminum, steel, and magnesium for a new part. Making the wrong choice can impact weight, cost, and manufacturing feasibility, setting a project back months.

Aluminum die casting offers the best overall balance for lightweighting. It is significantly lighter than steel, less costly and easier to process than magnesium, and offers excellent strength-to-weight ratios and recyclability. Steel is strong but heavy; magnesium is lighter but more expensive.

![]()

This is a conversation I have with customers almost every week. Steel is the traditional choice for strength, but for an EV, its weight is a major penalty against driving range. Magnesium is an exciting material; it’s even lighter than aluminum. However, it’s more expensive and can be more difficult to work with, especially regarding corrosion resistance and the casting process itself. Aluminum hits the sweet spot. It provides about two-thirds of the weight of steel for a similar part, at a manageable cost. Its processing is mature, reliable, and we can design complex features into the casting. When a purchasing director is trying to balance performance, cost, and manufacturability, aluminum almost always comes out as the most practical and effective solution for the majority of lightweight components5 in a modern vehicle.

Material Lightweighting Comparison

| Material | Density (g/cm³) | Key Advantage | Key Disadvantage |

|---|---|---|---|

| Steel | ~7.85 | High strength, low cost | Very heavy |

| Aluminum | ~2.70 | Excellent balance of strength, weight, and cost | Not as strong as steel |

| Magnesium | ~1.74 | Lightest structural metal | Higher cost, processing complexity |

What future technologies and sustainability trends will drive the aluminum casting market?

Your current suppliers are reliable, but are they ready for the future? Partnering with a supplier who isn’t investing in new technology and sustainability can leave your company exposed to future risks.

The future of the market will be driven by Industry 4.0 technologies like digital twin simulations and AI-driven process control. On the sustainability front, the focus will be on using recycled aluminum and developing advanced, high-strength alloys to further reduce vehicle weight.

The die casting process of today looks very different from when I started. Now, before we even cut the steel for a mold, we use advanced software to simulate the entire casting process. We create a "digital twin" of the part and process to predict how the metal will flow, identify potential defects, and optimize the design for manufacturability. This saves weeks of trial and error. Looking forward, AI and machine learning will further refine this by making real-time adjustments on the factory floor. The other massive driver is sustainability. Aluminum is infinitely recyclable, and using recycled content requires only 5% of the energy needed to produce primary aluminum. Our customers in Europe are especially focused on this. They want to know our percentage of recycled material and our plan to increase it. The future belongs to suppliers who can combine high-tech manufacturing with a truly circular economy model.

Conclusion

The aluminum casting market6 is large, growing, and essential to modern manufacturing, especially in the automotive sector7. Driven by the EV revolution, its future success will depend on leveraging new technologies and embracing sustainability.

-

Learn about sustainability trends that can enhance your company’s competitive edge. ↩

-

Understanding thermal management is crucial for optimizing EV performance. ↩

-

Identifying risks can help you mitigate disruptions in your operations. ↩

-

Understanding China’s influence can inform your global sourcing strategies. ↩

-

Learn how lightweighting impacts vehicle performance and efficiency. ↩

-

Explore insights on the aluminum casting market’s growth and trends to stay ahead in your industry. ↩

-

Discover how automotive demands shape the aluminum casting landscape and future opportunities. ↩